Account Recharge

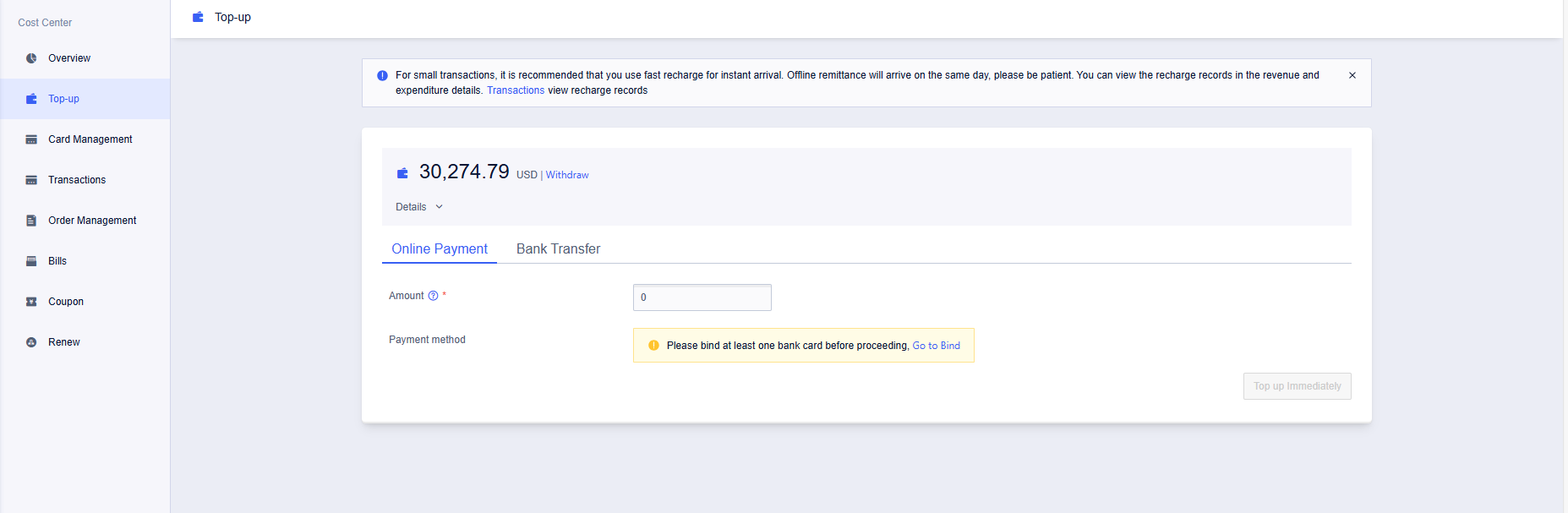

ZOSOC supports both quick recharge and offline remittance to recharge the account. Users can operate in the Cost Center >> Recharge and Withdraw >> Recharge .

Recharge

1、Quick Recharge Enter the recharge page, fill in the recharge amount and select the recharge channel to complete the subsequent operations.

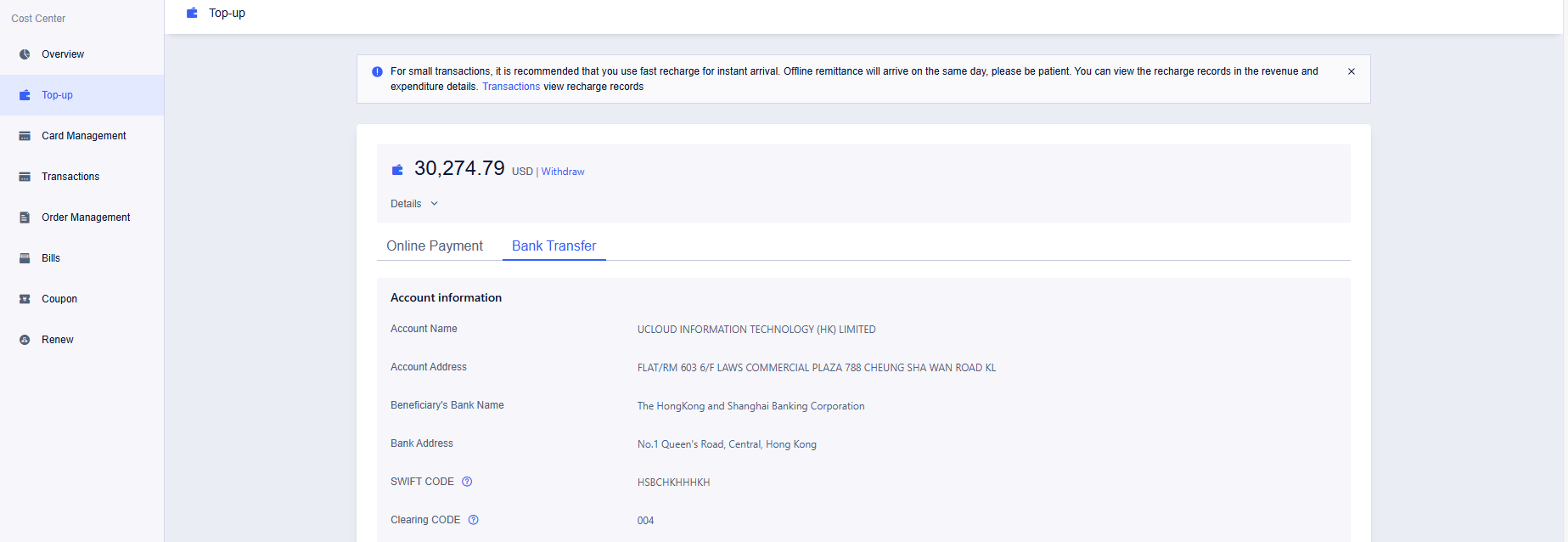

2、Offline remittance

Enter the recharge page, view the transfer recharge, and do the financial transfer operation according to the account information provided on the page.

It is recommended to use the exclusive account to recharge, the amount will be directly charged to your ZOSOC account; manual transfer is expected to arrive at the account in 2-3 working days after the operation is completed.

Please indicate the following information in the message box or comment box when you transfer or remit the money:

- Name of the paying organization or name

- Purpose of payment

- Your registered email address at ZOSOC If you need to check the progress of your payment, please contact your account manager at ZOSOC or “Online Inquiry”.

3、Offline Remittance (Overseas) If you need to recharge in foreign currency or pay bills in foreign currency, please enable the function of offshore remittance. The audit time is about 2 working days. Note: Only corporate customers who have passed the audit can use offline remittance (overseas). Foreign currencies will be automatically converted to RMB according to the exchange rate to recharge into the account. The arrival amount is affected by the following factors:

-

Bank charges (please choose both sides to bear the charges)

-

Exchange rate (the platform defaults to use the State Administration of Foreign Exchange’s median price on the first of the month for conversion.)

-

Recommended to use the exclusive account to recharge, and the amount will be directly charged to your ZOSOC account upon arrival:

-

Hong Kong region: 24 hours to the account under non-holiday and other special circumstances;

-

Non-Hong Kong area: 2-3 working days to the account; Manual transfer charging method is expected to arrive at the account 7 working days after the operation is completed.

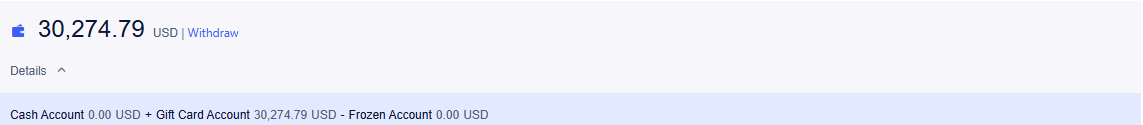

Freeze

In actual business scenarios, such as when users apply for hardware from UReach, they are required to provide a deposit, and the platform will freeze the corresponding account balance. According to the Measures for the Administration of Invoices of the People’s Republic of China, an invoice is a payment or receipt voucher issued or received in the purchase and sale of goods, the provision or acceptance of services, and the engagement in other business activities. Since the payment of a deposit does not directly involve the purchase and sale of goods or services, there is no need to issue an invoice. Only a receipt will be provided to ensure the smooth performance of the transaction or as a guarantee against possible damages.

Freeze Details

Customers can check the details of the frozen amount in the console. It should be noted that only the freeze details from October 2024 onwards are provided. For any questions regarding historical freezes, please consult the account manager.

Suggestions for operation in specific scenarios

- When the business has not been terminated, if the customer needs relevant vouchers for account entry purposes, they can request a receipt for the corresponding frozen amount from ZOSOC. Please contact the account manager or online customer service for handling.

- After business termination

- For UReach hardware products, the customer shall return the equipment to ZOSOC. ZOSOC will return the deposit (i.e., unfreeze it in the corresponding cloud account) after receiving the equipment and confirming that it is in good condition through inspection. Once the deposit in the customer’s cloud account is unfrozen, the corresponding receipt will automatically become invalid. If the deposit does not need to be returned eventually, and there are activities such as the purchase and sale of goods, the provision or acceptance of services, and other business operations that meet the regulations for invoice issuance, invoices will be issued according to the applicable tax rate, and value-added tax will be paid.

- For other product types, operations shall be carried out in accordance with their corresponding product descriptions and actual business scenarios.